how are annuities taxed to beneficiaries

Make Your Money Work Smarter And Get Guaranteed Monthly Income For Life. Understand What an Income Annuity is How it Works.

If the annuity is not held within an IRA you have 5 years to withdraw the annuity.

. Ad Annuities Is a Resource for Consumers Doing Research for Their Retirement Planning. Help Fund Your Retirement Goals with an Annuity from Fidelity. Want to Learn More About Annuities.

DistributeResultsFast Is The Newest Place to Search. Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts. Find Useful And Attractive Results.

In most cases however the owner of an annuity names a beneficiary who will inherit it in the event of their demise. Lifetime pension annuity payments from value protection guarantee periods and joint life annuities are tax-free if you as the original annuitant are under. Amounts paid under the five-year.

However the way in which the. If you die prematurely your retirement annuity will pay a death benefit to your estate or chosen beneficiaries. Ad Search For Are Inherited Annuities Taxable.

Before age 75. The details also depend upon the specifics of the annuity. Find Useful And Attractive Results.

Ad Search For Are Inherited Annuities Taxable. The proceeds from an annuity death benefit are taxable when they are received by the beneficiary. Review How Income Annuity Payments Work.

Ad Get this must-read guide if you are considering investing in annuities. Any money you take out before age 59½ will also. A stretch provision is perhaps the single most effective option for minimizing tax liability when the time comes to distribute the funds of your non-qualified annuity to your.

Yes inherited annuities are taxed as gross income which means that the beneficiaries owe taxes. Ad Curious About Income Annuities. These payments are not tax-free however.

Qualified Annuity Taxes. Ad Learn More about How Annuities Work from Fidelity. Rather the annuity beneficiary ies will owe income tax on the difference between the contributions that were made to the annuity and the value of the annuity contract at the time.

Those amounts are taxable at the ordinary rate and your heirs can choose. When you make withdrawals or begin taking regular payments from the annuity that money will be taxed as ordinary income. If the contract was purchased with after-tax funds meaning money that has been reported to the IRS as income and taxed accordingly then the annuity is non-qualified.

DistributeResultsFast Is The Newest Place to Search. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Discover what you should know about annuities in the context of your retirement portfolio.

If youre the spouse of the original annuitant then you can choose to. This also lets the beneficiary only pay taxes on a portion of the annuity each year. In the case where the recipient is a surviving spouse he or she can initiate.

When using a qualified annuity such as one in an employers retirement plan or a traditional IRA the contributions you make typically reduce. A beneficiary of an employee who was covered by a retirement plan can exclude from income a portion of nonperiodic distributions received that totally relieve the payer from. Everything You Need To Know.

Even though all annuities are issued by life insurance companies annuity death benefits are fully taxable to the annuity policy. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. If a trust charity or estate is the beneficiary of a.

Everything You Need To Know. Ad Learn the pros and cons of annuities and why an annuity may not be a good investment. The internal revenue service IRS taxes annuity income to the extent of gains distributed from the contract and gains are distributed first.

How are annuity death benefits taxed. If the annuity is held in an IRA. Unlike death benefits paid from life insurance policies the beneficiary may be taxed on distributions made from an annuity after the owners death.

The simple answer to Are inherited annuities taxable is.

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Vs Mutual Funds Which Is Right For You 2022

Trust Vs Restricted Payout As Annuity Beneficiary

What Is The Tax Rate On An Inherited Annuity Smartasset

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

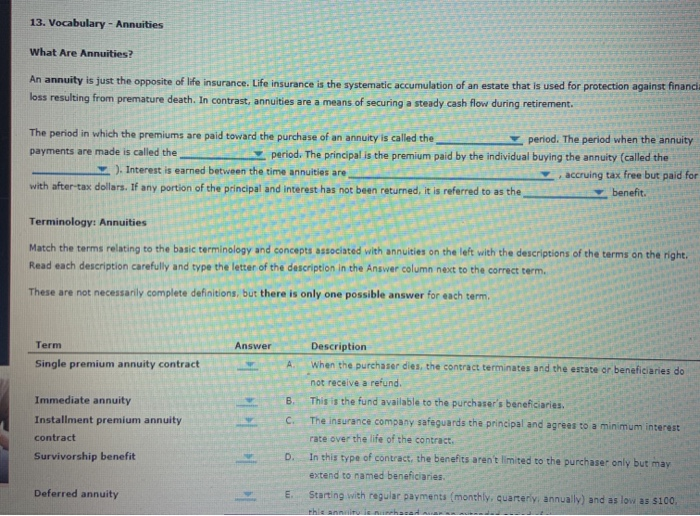

Solved Possible Options 1 Chegg Com

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Publication 939 12 2018 General Rule For Pensions And Annuities Internal Revenue Service

Annuity Tax Consequences Taxes And Selling Annuity Settlements

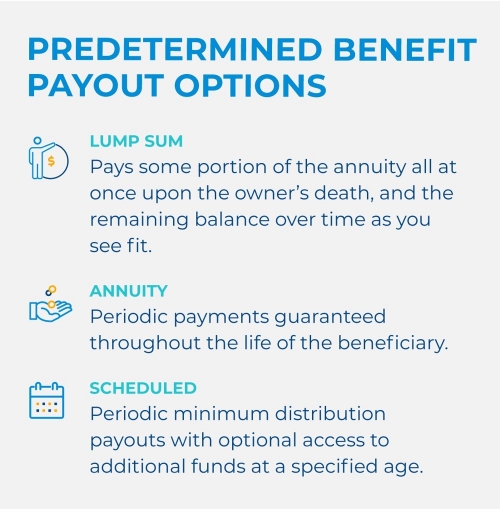

Managing Your Beneficiaries Inheritance Pacific Life

Tax Deferred Annuities Three Tips And A Trap

Qualified Vs Non Qualified Annuities Taxation And Distribution

Inherited Annuity Beneficiary Options

Charitable Remainder Trusts Crts Wealthspire

Annuities Are Highly Customizable And Can Offer Tax Advantages Payment Periods Tailored To Your Needs Protection Against Losing Your Initial Investment By Annuity Org Facebook

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Taxation How Various Annuities Are Taxed